The new tax bill highlights. Congress has passed the largest piece of tax reform legislation since 1986. However, this bill will not affect the taxes for 2017 (the one you file in 2018). In case you’re wondering how you’re affected, here is a short explanation of the main topics on the bill.

TAX RELIEF FOR INDIVIDUALS AND FAMILIES

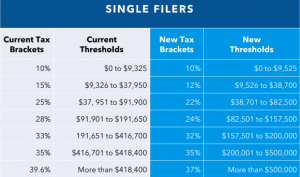

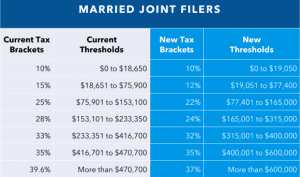

Lower Tax Rates and Changed Income Ranges: The new tax bill retains the seven tax brackets found in current law but lowers a number of the tax rates. It also changes the income thresholds at which the rates apply. The current brackets are: 10%, 15%, 25%, 28%, 33%, 35% and 39.6% and the new brackets will be: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Please take a look at these charts to understand this point. Look at the table included in images so you understand the example.

For example, you are married filing jointly (you and your spouse together) and your combined household income is $18,650.00; this means that in 2017 (the ones you file in 2018) you still will pay 15% but in 2018 (the ones you file in 2019) you have to pay only 10%.

Increased standard deduction: The new tax bill nearly doubles the standard deduction amount. Single taxpayers will see their standard deductions jump from $6,350 to $12,000 in the new bill. Married couples filing jointly see an increase from $12,700 to $24,000.

These increases mean that fewer people will have to itemize. Currently, about 30% of taxpayers itemize all their deductions. Under the new law, this percentage is expected to decrease.

Increased Child Tax Credit: For families with children, the Child Tax Credit is doubled from $1,000 per child to $2,000. In addition, the amount that is refundable grows from $1,100 to $1,400.

The bill also adds a new, non-refundable credit of $500 for dependents other than children, such as children over age 17, elderly parents or adult children with a disability. Finally, the new tax bill raises the income threshold at which these benefits phase out from $110,000 for a married couple to $400,000.

Alternative Minimum Tax Exemptions Increased: The alternative minimum tax (ATM), a parallel tax system that ensures people who receive a lot of tax breaks still pay some federal income taxes, remains in place for individuals.

The new tax bill eases the burden of the alternative minimum tax (AMT) by raising the income exempted from $84,500 (adjusted for inflation) to $109,400 married filing jointly and from $54,300 (adjusted for inflation) to $70,300 for single taxpayers, so fewer taxpayers will pay it.

Electric Car Tax: Drivers of plug-in electric vehicles can still claim a credit of up to $7,500. Just as before, the full amount is good only on the first 200,000 electric cars sold by each automaker. GM, Nissan and Tesla are expected to reach that number next year.

ELIMINATIONS OR REDUCTIONS IN DEDUCTIONS

Personal and dependent exemptions: The new tax bill eliminates the personal and dependent exemptions. Previously, you could claim a $4,050 personal exemption for yourself, your spouse and each of your dependents, which lowered your taxable income. Not anymore. This elimination could reduce or negate the tax relief some families get from other parts of the new reform.

State and local taxes/Home mortgages: The new tax bill limits the amount of state and local property or SALT deductions, and sales taxes that can be deducted to $10,000. Previously, filers could deduct an unlimited amount for state and local property taxes, plus income or sales taxes.

The bill also caps the amount of mortgage indebtedness on new home purchases on which interest can be deducted. Anyone buying a new home will only be able to deduct the first $750,000 of their mortgage debt. That's down from $1 million in the current law.

Healthcare: The new tax bill eliminates the tax penalty for not having health insurance after December 31, 2018. It also temporarily lowers the out-of-pocket medical expenses that can be deducted from the current law floor of 10% to 7.5% for 2017 and 2018. So, for 2017 and 2018, you can deduct medical expenses that are more than 7.5% of your adjusted gross income.

Alimony: Alimony payments, codified in divorce agreements and go to the ex-spouse who earns less money, are no longer deductible for the person who writes the checks. This will apply to couples who sign divorce after Dec 31, 2018.